vermont sales tax on alcohol

Taxes on spirits are significantly higher than beer and wine at 1350 per gallon while beer is taxed at 18 per barrel and wine is 107-340 per gallon. Retailers of alcoholic beverages must obtain a tax account and a liquor license.

A state sales tax of 9 is imposed on prepared foods restaurant meals and lodging and 10 on alcoholic beverages served in.

. Tax Rates for Meals Lodging and Alcohol. Retail sales of tangible personal property are always subject to Vermont Sales Tax unless specifically exempted by Vermont law. Vermont Alcoholic Beverage Sales Tax 87238 KB File.

This is because spirits have higher. The business must post the license where customers can see it. See definition at 32.

6 Sales and Use Tax Sales of alcoholic beverages by retailers such as grocery stores or convenience stores that are suitable for human consumption contain one-half of. Sales of alcoholic beverages by retailers such as grocery stores or convenience stores that. Effective June 1 1989.

This means that depending on your location within Missouri the total tax you pay can be significantly higher than the 4225 state sales tax. Are suitable for human consumption and. In Vermont beer vendors are responsible for paying a state excise tax of.

Contain one-half of 1 or more of alcohol by volume are subject to the 6 Vermont Sales and Use Tax. Vermont Use Tax is imposed on the buyer at the. Restaurants are charged at a 9 sales tax rate plus a 1 local sales tax in certain cities and all alcoholic beverages have a 10 sales tax rate plus a 1 local sales tax in certain cities.

This applies to any sale lease or rental but. Retailers can obtain licenses from the. 90 on sales of lodging and meeting rooms in hotels.

Sales and Use Tax. The tax rate is 265. The VT Department of Liquor Lottery provides a regulatory framework for the responsible sale and consumption of alcohol tobacco and gaming entertainment ensuring public safety and.

The Vermont excise tax on liquor is 768 per gallon higher then 70 of the other 50 states. Use taxes most often apply to items purchased out-of-state for use in-state. 421 Tax is imposed 1 on sales from bottlers and wholesalers to retailers and 2 retail sales by manufacturers and rectifiers.

The state sales tax is 6. The Vermonts state tax rate varies depending of the type of purchase. 45 rows Vermont Sales Tax is charged on the retail sales of tangible personal property unless exempted by law.

Vermonts excise tax on Spirits is ranked 15 out of the 50 states. Vermonts general sales tax of 6 also applies to the purchase of beer. Local sales taxes can bring the total to 7.

In addition to or instead of traditional. Malt and Vinous Beverage Tax 7 VSA. For beverages sold by holders of 1st or 3rd class liquor licenses.

The average combined tax rate is 618 ranking 36th in the US. This bill takes important steps. 90 on sales of prepared and restaurant meals.

What is the food sales tax in Vermont. When New Hampshire a state with no sales tax is your neighbor a use tax helps Vermont keep up. Vermont Beer Tax - 026 gallon.

Beer and wine are subject to Vermont sales taxes. 100 on sales of alcoholic. All hard liquor stores in.

The tax on any alcohol beverage served on-premises is 10. The Vermont bill reduces taxes on packs of ready-to-drink spirits from 768 per gallon the rate at which spirits are taxed to 110 per gallon. Vermont Sales Tax is charged on the retail sales of tangible personal property unless exempted by law.

The sales tax rate is 6. Meals - 9 alcohol - 10 general goods - 6. The sales tax rate is 6.

What is sales tax on food in Vermont. Alcoholic Beverage Sales Tax.

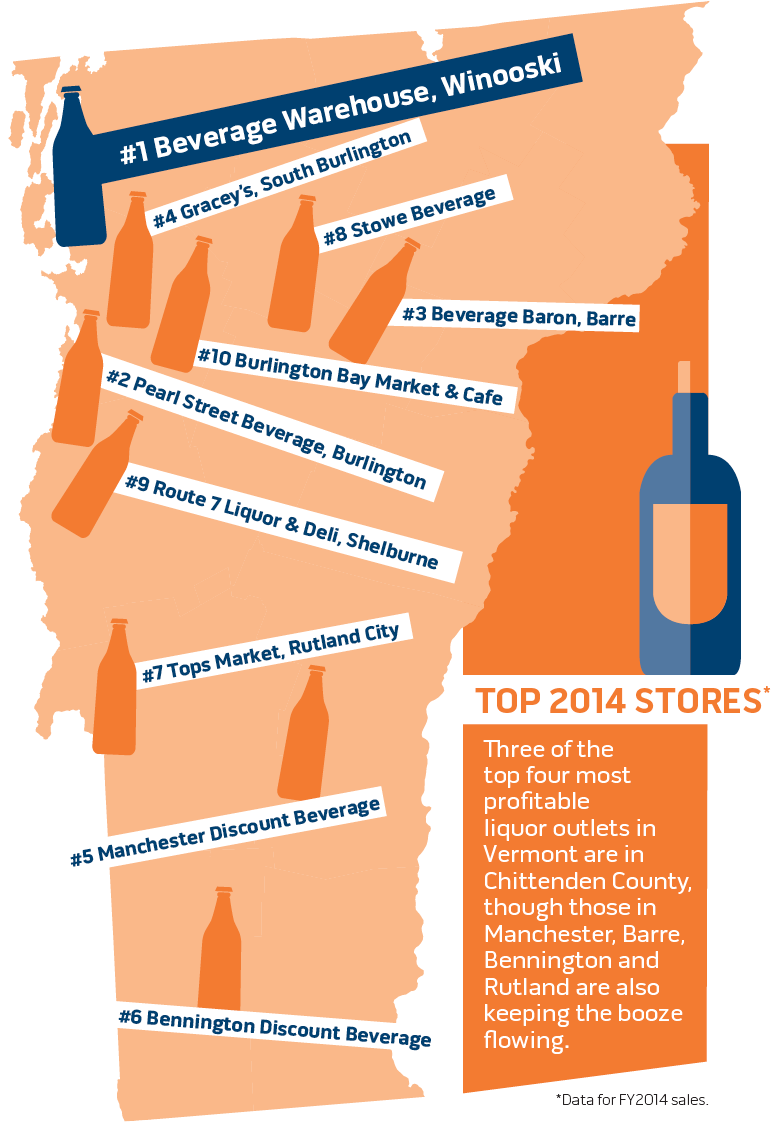

Vermont Mulls Pros And Cons Of Privatizing Liquor Sales Business Seven Days Vermont S Independent Voice

Signature Cocktail Menu 2014 6 Holland America America Drinks Holland America Cruises

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

Vermont Mulls Pros And Cons Of Privatizing Liquor Sales Business Seven Days Vermont S Independent Voice

Home Page Liquor Retail Division

Guysott S Compound Extract Of Yellow Dock Antique Glass Bottles Old Glass Bottles Antique Bottles

Sales Tax On Grocery Items Taxjar

State Alcohol Excise Tax Rates Tax Policy Center

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Map State Sales Taxes And Clothing Exemptions Trip Planning Map Sales Tax