nc sales tax on food items

Sale and Purchase Exemptions. The North Carolina sales tax rate is 475 as of 2022 with some cities and counties adding a local sales tax on top of the NC state sales tax.

In the state of North Carolina sales tax is legally required to be collected from all tangible physical products being.

. The sales tax rate on food is 2. The North Carolina sales tax rate is 475 as of 2022 with some cities and counties adding a local sales tax on top of the NC state sales tax. Certain items have a 7-percent combined general rate and some items have a.

North Carolina Sales Tax Guide. The North Carolina state sales tax. Nc sales tax on non food items.

County and local taxes in most. The information included on this website is to be used only as a guide. Depending on local municipalities the total tax rate can be as high as 75.

Exemptions to the North Carolina sales tax. A customer buys a toothbrush a bag of candy and a loaf of bread. Exemptions to the North Carolina sales tax.

Items subject to the general rate are also subject. The North Carolina NC state sales tax rate is currently 475. Arkansas Grocery items are not tax exempt but food and food ingredients are taxed at a reduced Arkansas state rate of 15.

The North Carolina sales tax rate is 475 as of 2022 with some cities and counties adding a local sales tax on top of the NC state sales tax. Total General State Local and Transit Rates County Rates Items Subject Only to the General 475 State Rate Local and Transit Rates do not. Some states charge a lesser sales tax on food items as of 2022 including.

The sales tax rate on food is 2. It is not intended to cover all provisions of the law or every taxpayers. Fast Easy Tax Solutions.

County and local taxes in most. Retail Sales Retail sales of tangible personal property are subject to the 475 State sales or use tax. While the North Carolina sales tax of 475 applies to most transactions there are certain items that may be exempt from taxation.

North Carolina Department of Revenue 11509 Page 2. Sales and Use Tax Rates. Items subject to the general rate are also subject.

This page describes the. Fast Easy Tax Solutions. Friday June 10 2022.

Sales and Use Tax Sales and Use Tax. The North Carolina NC state sales tax rate is currently 475. This page discusses various sales tax exemptions in North.

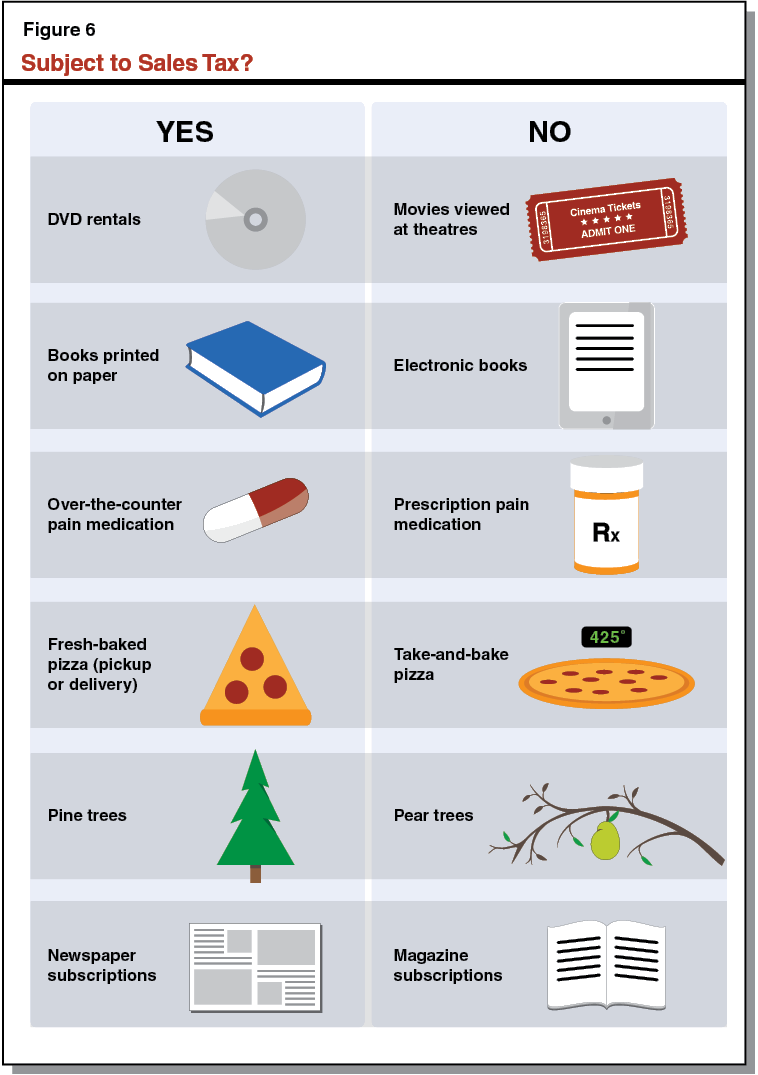

While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Exemption for Packaging Items for Food. What transactions are generally subject to sales tax in North Carolina.

Arizona grocery items are tax exempt. Exemptions to the North Carolina sales tax. Retail Sales Retail sales of tangible personal property are subject to the 475 State sales or use tax.

The sale at retail and the use storage or consumption in North Carolina of tangible personal property certain digital property and services specifically. Ad Find Out Sales Tax Rates For Free. North Carolinas general state sales tax rate is 475 percent.

Wilmington NC community events for sale gigs housing jobs resumes services all adminoffice. Purchases food items and combines two or more of the items in a package or gift. Depending on local municipalities the total tax rate can be as high as 75.

Ad Find Out Sales Tax Rates For Free. According to North Carolina law youd be required to charge the full Murphy NC sales tax amount of 7. Qualifying Food A 200 local rate of sales or use tax applies to retail sales and purchases for storage use or consumption of qualifying food.

The State and applicable local sales and use tax. Laundries Apparel and Linen Rental Businesses and Other Similar Businesses.

The Brief History Of Gst Goods And Service Tax Goods And Services Goods And Service Tax Get Gift Cards

Soft Magnetic Letters Rust In 2022 Magnetic Letters Alphabet Magnets Alphabet For Kids

Sales Tax On Grocery Items Taxjar

Is Food Taxable In North Carolina Taxjar

Sales Tax Exemption For Farmers Carolina Farm Stewardship Association

Exemptions From The North Carolina Sales Tax

States Can Thoughtfully Implement Grocery Tax Reforms To Help Families And Improve Equity Center On Budget And Policy Priorities

Epcot Festival Of The Arts Information Epcot Festival Food Network Recipes

Tree Mendously Tasteful Cookie Pattern 135 Primitive Etsy Christmas Christmas Tree Cookies Christmas Crafts

Understanding California S Sales Tax

Stunt Foods Food Articles Food Innovation Fast Food Items

N C Dept Of Revenue Ncdor Twitter

Holy Meaningful Receipt Roland Ginger Ale Mozzarella Sticks Receipt

Is Food Taxable In North Carolina Taxjar

Is Food Taxable In North Carolina Taxjar

Twinkles Light Bulb Ornie Pattern 148 Primitive Doll Pattern Christmas Light Bulb Twinkle Ornament Fiber Art English Only